list Of Names For Unclaimed Money In Ma

Home

You found the complete source for total information and resources for list Of Names For Unclaimed Money In Ma on the web.

Each state’s page will look a little different, but most will only require you to enter your name and will give the option to include an address to get more precise results. That means if you didn’t file taxes for that year, the government doesn’t know where to send your money. For example, the IRS could take your 2018 refund to pay taxes you owe for other years or to pay off certain other debts. Cathy Boone died in January 2020 in a warming shelter after living on the streets of the city of Astoria, contending with drug and mental health issues, KGW, the NBC affiliated TV station in Portland reported. In the past two years or so, the division has begun sending targeted letters to those with claims worth a minimum $10,000, he said. But remember that there are limits to the amount you can contribute to an IRA each year.

Traditional IRAs help lower your tax burden because they can be deductible up to the contribution limit, which means your taxable income will be lowered by the amount you put in the IRA. Curran says that the abandonment of will searches may have led to people's money. Visitors can learn more about Internet crime, review a "Frequently Asked Questions" gallery and view e-mail fraud and Internet scam examples. At the very least, learn where important documents and other information is stored, and be sure you have access.

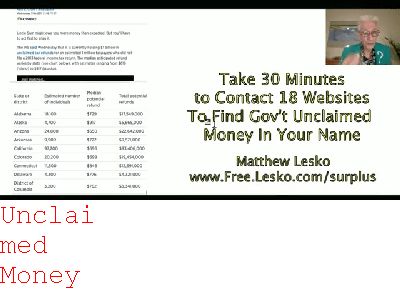

So instead of having to search dozens of government sites to find your money - you can search all these records from one location on our site. Upon or prior to publication, a party of interest may file a claim with the treasurer which must include the claimant's name, address, amount of claim, the grounds on which the claim is founded and any other information required by the treasurer. The Unclaimed Property law was enacted in 1970 to enable Wisconsin residents to search in one place for missing funds.

Across the nation more than $7 billion in unclaimed property is sitting at state treasurers’ offices, waiting for people to claim their money, for free. We also offer optional claim monitoring if you'd like to have that.

“It’s less than 1% where there’s that gap, but anyone can call that 1-800 number,” Wooden said. Each account may require a different type of documentation that would allow the claim to be proved. When there has been no contact with the owner, the lease has expired and no further rental payments have been made, then a safe deposit box is considered legally unclaimed. Finally, although you can find some information on unclaimed life insurance policies on state websites, they can be more difficult to locate than you might imagine. From 2000 to 2021, the state treasurer’s office collected more than $2.3 billion in unclaimed property - in the form of forgotten bank accounts, insurance payments and more - but returned less than 37% percent of that amount to its rightful owners, according to a Connecticut Mirror investigation published earlier this year. California’s Unclaimed Property Law requires “holders”, which include corporations, businesses, associations, insurance companies, and financial institutions, to report and deliver property to the California State Controller’s Office after there has been no activity on the account or contact with the owner for a specific period of time, which varies according to the type of account or property, but is generally three or more years.

If you’re part of the 10% of people who have unclaimed money tied to their name, that could be the case. “When we return unclaimed money, we are stimulating the state’s economy without increasing the burden on taxpayers.

Here are Some More Details on md treasury unclaimed money

Life insurance is commonly described as a contract where the insurer agrees to pay a fixed sum of money in case of the insured’s death or terminal illness. This assignment was a perplexing one to me, because there really isn't any good data on how much money people lose.

You may search the unclaimed funds list by clicking here. In the past five years, the office has refunded nearly $520,000.

“It’s like Christmas all over again,” Lisa Howes said with a laugh. Retirement Savings Contributions Credit - Also known as the Saver's Credit, this nonrefundable credit gives back a portion of the contributions you make to a qualified 401(k) or individual retirement account - up to $2,000 for singles or $4,000 for married couples filing jointly.

Who Owns the SeRP? Undeliverable bonds are -- guess what! The proactive programs are likely to continue, Gardelli said, and the state eventually may send unsolicited checks for up to $500 if it can identify owners. This money comes from sources like dormant bank accounts, uncashed checks, safe deposit box contents, and unpaid insurance benefits. Directors who bury the indigent and unclaimed from March on will have to try recouping money from the state later, but there’s no guarantee, Kimes said.

Even more Information Around new mexico unclaimed money

If you can't file your income tax return on time, you can get an extension until October 17. But remember that there are limits to the amount you can contribute to an IRA each year. Most closed loop cards don't have any activation or transaction fees since it's easier for retailers to make their money back -- and more -- from gift card sales.

If you think you were due a refund from 2018 but you don't receive one after you file your old tax return, all or part of your tax refund may have been offset, meaning it was used to pay past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support or other federal debts such as student loans. But in fact, she was owed for another 10 hours of work. The Department of Finance (DOF), as one of many responsibilities, works to return unclaimed money to the rightful owners. Your last name will most likely be required, but you can try using or skipping the suggested fields to narrow or broaden the results. The primary objective of the unclaimed property program is to reunite rightful owners or heirs with their unclaimed property, which is remitted to the Office of the Treasurer by business entities after the business loses contact with a customer for a period of three to five years. All stale-dated uncashed checks, interest earned on deposits, and garnishment deposits (which are no longer collected) are turned over to the Florida Department of Financial Services by April 30 each year if the clerk’s office received them prior to Jan.

Very often you will find that a slightly older ex-colleague may well have faced this exact same situation themselves in the recent past. Support innovative FAFSA grant to districts. The state of New York currently holds $14 billion in unclaimed cash. Businesses, nonprofit organizations and other groups can also have unclaimed property, as there are more than 1.7 million names of individuals and businesses for whom property is available listed on the division’s website. Process your claim for payment. A loved one may have passed without even telling you that there’s a life insurance policy with your name on it.

Below are Some More Details on new mexico unclaimed money

The Department for Work and Pensions this week launched a campaign to increase awareness and uptake. That's especially true if you plan to make a contribution soon anyway. Asset tracers track down family members and heirs of deceased relatives, demanding 35% or more for information on an unclaimed inheritance. This is due to a recent finding that most businesses weren’t in compliance with the Employee Retirement Income Security Act of 1974 (ERISA), which mandates that plan fiduciaries must make every effort to locate missing plan participants. TreasuryDirect. "Treasury to End Over-the-Counter Sales of Paper U.S. Savings Bonds; Action will save $70 million over first five years." United States Department of the Treasury.

If you’ve moved around a bit, it could be that a tax refund was sent to an old address and returned as undeliverable. Sometimes called unclaimed property, unclaimed money results from inactivity or no contact related to various accounts people set up. That's a step in the right direction, because even if your parents are healthy or too young at heart to worry, time isn't on anyone's side. They'll help you investigate your relatives (genealogy), past addresses, work history and absolutely every piece of information that might lead to the discovery of missing money and other assets that could be hiding ina variety of places under a variety of different names. Hardy said sometimes different divisions or branches may have different transactions or perhaps court fees. It uses information about unclaimed property that is cut and pasted from the organization’s website and refers to federal statutes and IRS rules. To do this, just follow the detailed directions on the state administrator's website. To learn more about unclaimed luggage, baggage handling and airlines, carry on to the next page. People should check often because each year millions of additional dollars of unclaimed money are submitted. ► Forgotten Money and CD’s at Banks and Credit Unions Dormant accounts worth billions of dollars go unclaimed each year, often due to name or address changes after marriage or divorce, and upon death of a family member. If you already have a claim ID in Illinois, click here to check its status.

This year, you must file your return for the 2021 tax year - in other words, for the income you received from January 1 to December 31, 2021 (unless you're a fiscal-year filer, which is rare). The state of New York currently holds $14 billion in unclaimed cash. The problem is likely to continue, as there is no requirement in England and Wales to lodge a copy of a will with the courts or a Government agency. The contribution deadline for the 2021 tax year for Health Savings Accounts is also April 18. If it returns undelivered, the Town adds the check number, name, date and amount to a list of unclaimed money.

Although some websites attempt to aggregate information from multiple states, there is still no national department that has information for the whole country. If you have a workplace retirement plan, like a 401(k), the full deduction is capped according to income. crats and Republicans voiced support for the legislation during the committee hearing this week, arguing the state needed to make it much easier for people to reclaim their lost money. There are too many unclaimed awards that the lottery merely will get to keep as a result of no one claiming their prize money. This year, your taxes are due on April 18.

Retain recent records, but shred all those old utility bills your mom's had boxed up since the '70s - your parents don't need them now, and you won't need them later. Earlier this week, Florida Chief Financial Officer Jimmy Patronis announced that Escambia and Santa Rosa counties have more than $38 million in unclaimed property held by the Department of Financial Services. Why is there so much unclaimed money? So how much lost money is floating around out there? In 2017, for instance, unclaimed property revenues topped $129 million for the year, which was money that did not need to be found elsewhere in the form of taxes or fees. And if those kids make going to work a challenge, there's a tax credit to help cover the cost of day care.

property, money, state, claim, search, government, owner, states, office, service, address, claims, form, treasury, find, funds, department, refund, program, name, business, checks, forms, treasurer, security, report, resources, division, bureau, estate, certificate, tax, check, phone, payment, businesses, owners, agencies, site, services,unclaimed property, unclaimed money, unclaimed property division, unclaimed property program, short certificate, national association, claim forms, unclaimed funds, state treasurer, deceased owner, tangible property, fiscal service, federal tax refund, unclaimed property search, google translate™, personal representative, security deposits, social security number, state treasurers, rightful owners, interactive map, official government, multiple states, unclaimed property administrators, rightful owner, new york state, pa. c.s.a, wills office, pennsylvania treasury, unclaimed assets,unclaimed property, pennsylvania, google, decedent, refund division

Previous Next

Other Resources.related with list Of Names For Unclaimed Money In Ma:

unclaimed Money Iowa

harris Eckland And Associates Unclaimed Money

unclaimed Money En Español

dr Oz Unclaimed Money

state Of Ohio Unclaimed Money